Superannuation or ‘super’ is money put aside during employment to fund retirement.

This money is put into your nominated Super Fund and invested on your behalf with the aim of growing your nest egg.

If you are over the age of 18 and earn more than $450 weekly, your employer typically must contribute 9.5% of your wage into your chosen super fund. This is known as the Super Guarantee.

You may also choose to top up your super with your own money by making voluntary contributions. These contributions can be salary sacrificed (made before tax), or post-tax.

Super is significant as it allows people to fund their retirement without relying solely on the modest age pension. If you understand and take control of your super from a young age, you gain the potential to live a comfortable retirement thanks to the power of compound interest.

Super funds

Super funds hold your money and invest it on your behalf for a small fee. There are many different types of super funds including:

- Industry Funds

- Retail Funds

- Self Managed Super Funds (SMSF).

Industry Funds are not-for-profit funds and seek profits with their members in mind. Meanwhile, retail funds are administered by financial institutions or banks, and aim to generate corporate profits through commissions.

Self Managed Super Funds (SMSF) are private superannuation funds managed by their sole owners, or a select few people in some cases.

SMSFs require copious knowledge about the stock market and investing, and are often used by people who wish to invest in different resources like bullion or cryptocurrencies.

Industry and Super funds employ experts to decide the best places to invest your money for you. In return, they charge an annual fee.

Fees range from fund to fund, so it is important to ‘shop around’ when selecting a fund. Industry Funds generally charge lower fees than retail funds, who seek to generate corporate profits through commissions.

Portfolio Options

When investing, don’t put all your eggs in one basket

– n.a

You’ve certainly heard the above notion. Super portfolios follow this advice too – by investing your money in different places.

You can choose where your money goes (to an extent) by selecting an appropriate portfolio. Each super fund has a wide range of pre-selected investment options.

Portfolios can include:

- Conservative (low-risk)

- Moderate (medium risk)

- Growth (high risk)

Each of these offer different investment risks and estimated returns. A ‘risk’ here is the chance you have of losing money.

Generally, the opportunity for more financial growth comes at the expense of greater risk.

If you select a growth portfolio, your money will be invested in more volatile areas like property and shares. Conservative portfolios tend to choose ‘safer’ investment options like cash or government bonds.

Choosing the right super portfolio is important. While having your super invested in the volatile property market may provide more long-term returns, it also comes with more risk.

If you’re fifty years away from retirement, growth options are great as you have time on your side to tolerate more risk and potentially gain in the long-term.

However, people soon approaching retirement may choose safer options like conservative portfolios to ensure less risk.

Alternative portfolio options are becoming popular. For environmentally conscious people, there are options like Hostplus’ socially responsible investment fund which invest your money ethically.

Voluntary Contributions

Unless you have a high-paying job, or your employer is generous, 9.5% of your income is a very modest amount to save for retirement.

Relying solely on employer contributions to retire may not cut it, especially if you want to live a comfortable retirement.

This is especially true for women, who have an average of 47% less super than men, according to Women in Super.

This downfall is caused by a multitude of factors including gender pay gaps and parental leave. However, one thing is certain: most people can grow their own super if they choose to.

By making voluntary super contributions, you can grow your super exponentially. These contributions can be either:

- Pre-tax (salary sacrifice); or

- After tax

Salary Sacrificing is giving up some of your salary before-tax to boost your super. It’s also a great way receive a tax concession.

Salary sacrificed super is taxed at a generous rate of up to 15%. This tax-rate is usually lower than post-tax rates, so it can be a great way to receive a tax concession. Let’s look at an example:

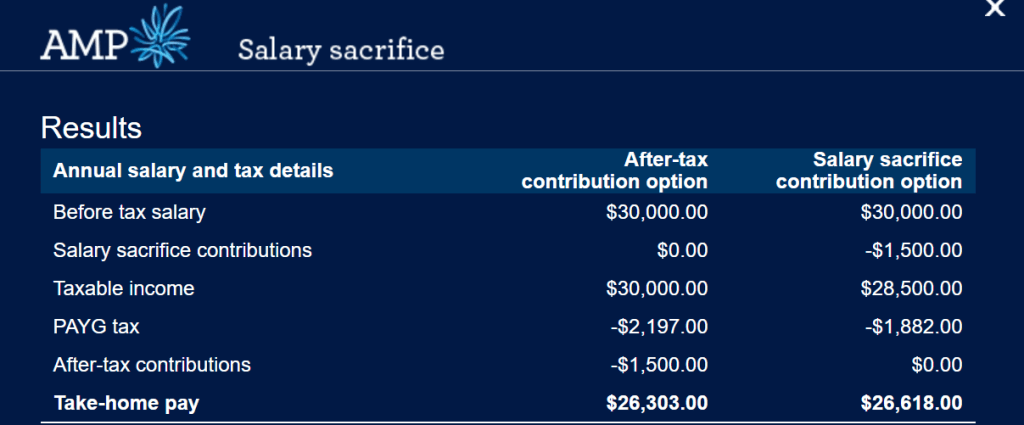

In the above example, salary sacrificing $1500 before-tax (right column) means you pay $1882 in tax, and take home $26618 for the year.

If the same $1500 contribution was made after tax (left column), $2197 in tax would be paid, and your take-home pay would be $26303.

Note: salary-sacrificed super contributions are taxed at 15%. So for the right-hand column, you would lose up to $225 of your contribution when it is put into your super fund.

If you want to salary sacrifice super, you can make arrangements with your employer to do so.

How much is enough?

The super guarantee is currently leglislated to reach 10% in the 2021-22 budget, and peak at 12% by July 2025.

As Australians live for longer, some people worry that relying solely on employer contributions won’t cut it.

ASIC’s MoneySmart estimates that it costs $39353 for a couple to live a ‘modest lifestyle’ annually. Meanwhile, couples seeking a ‘comfortable’ lifestyle spend an estimated $60,264.

So, if a couple both retire at 65, and want to live a comfortable lifestyle solely off their super for 20 years they’ll need a combined $1.2 million!

Other estimates aren’t so scary. ASFA estimates couples need $640,000 at retirement to live a ‘comfortable’ lifestyle, with some assistance form the age pension.

But, really. How long is a piece of string?

Answering this question depends on each person’s circumstance, needs, and wants during retirement.

You need to consider whether you’ll own a home or be renting, how long you might live, when you’ll retire, and much more.

If you’re young, it’s probably not worth stressing about Super yet. Just remember – when it comes to Super, more is better.

Here are some actions you can take to make sure your super is on track:

- Play around with Industry Super’s Retirement Calculator

- Consider making volountary contributions to boost your super

- Make sure your fund is charging reasonable fees

- Look into switching portfolio options to maximise growth

- Make sure your employer is paying your super (!)

- Check your super balance every six months

My take on Super

I’ve only had Superannuation for 18 months. During this time, I have earned $42,000 and received $4,200 in employer contributions.

I salary sacrifice 5% of my weekly pay, and have a super balance of around $8000 as a result. This money is split between HostPlus’ Shares Plus and Balanced pools.

I like to view Super as a long-term investment, and consider personal contributions ‘savings’.

Perhaps the only downfall is that this money cannot be accessed until retirement. This is not an issue as I only put in what I can afford to not need.

Like this post? Stay up to date with the latest from Avacado Money!

Disclaimer: This advice is general in nature and before making any financial decisions, you should consider your own personal circumstances and whether this advice is right for you.